The Future

of Algorithmic Trading

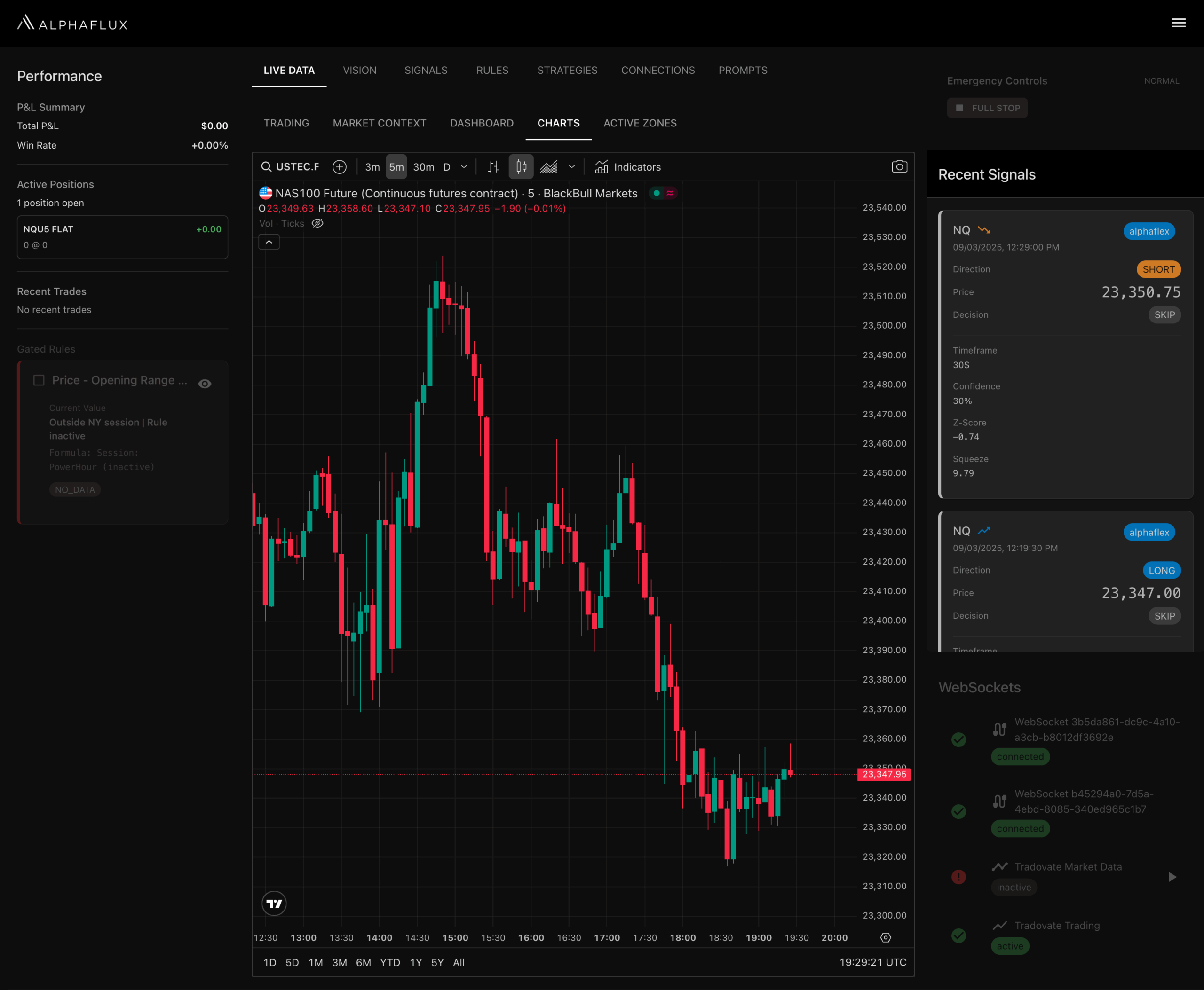

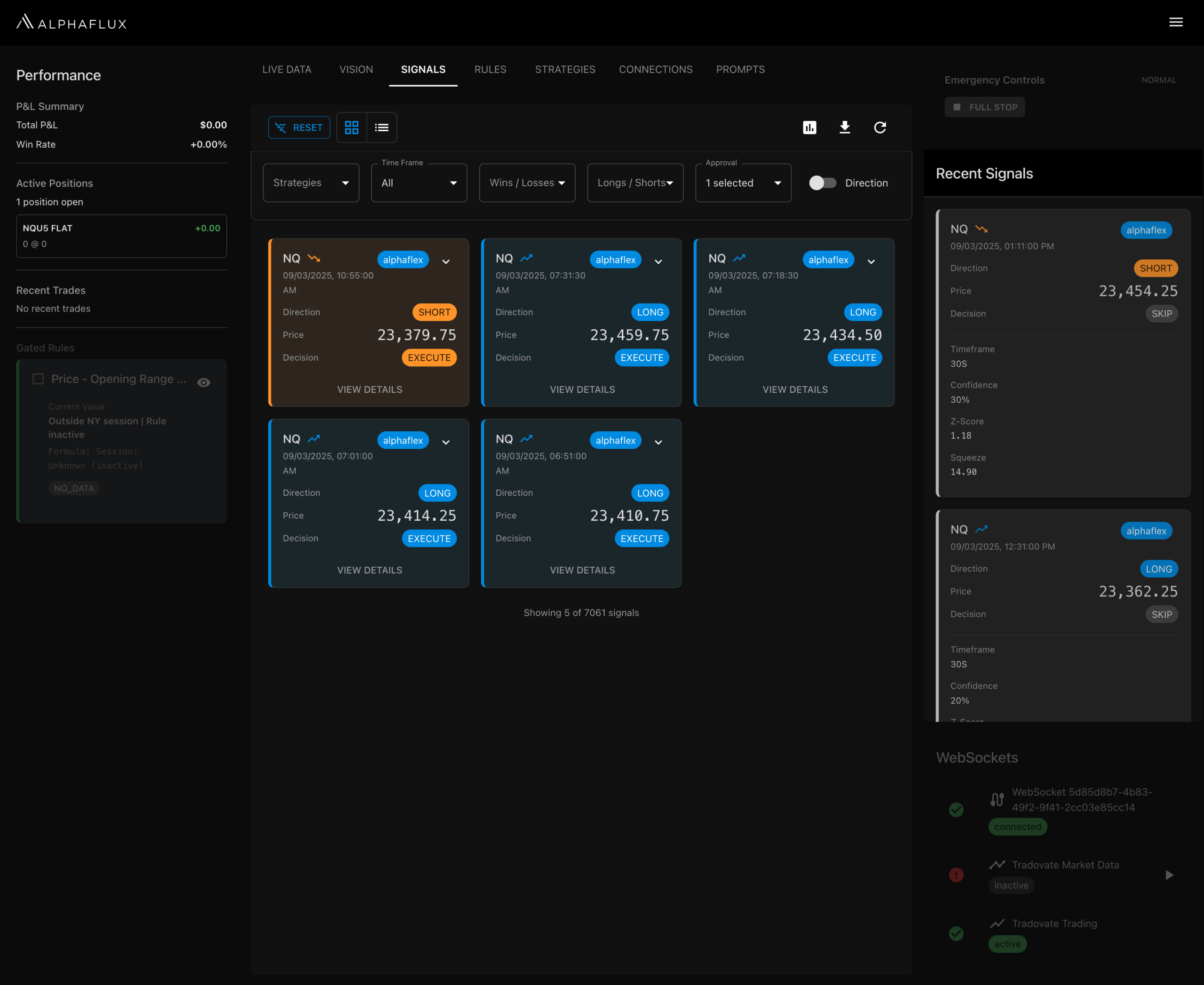

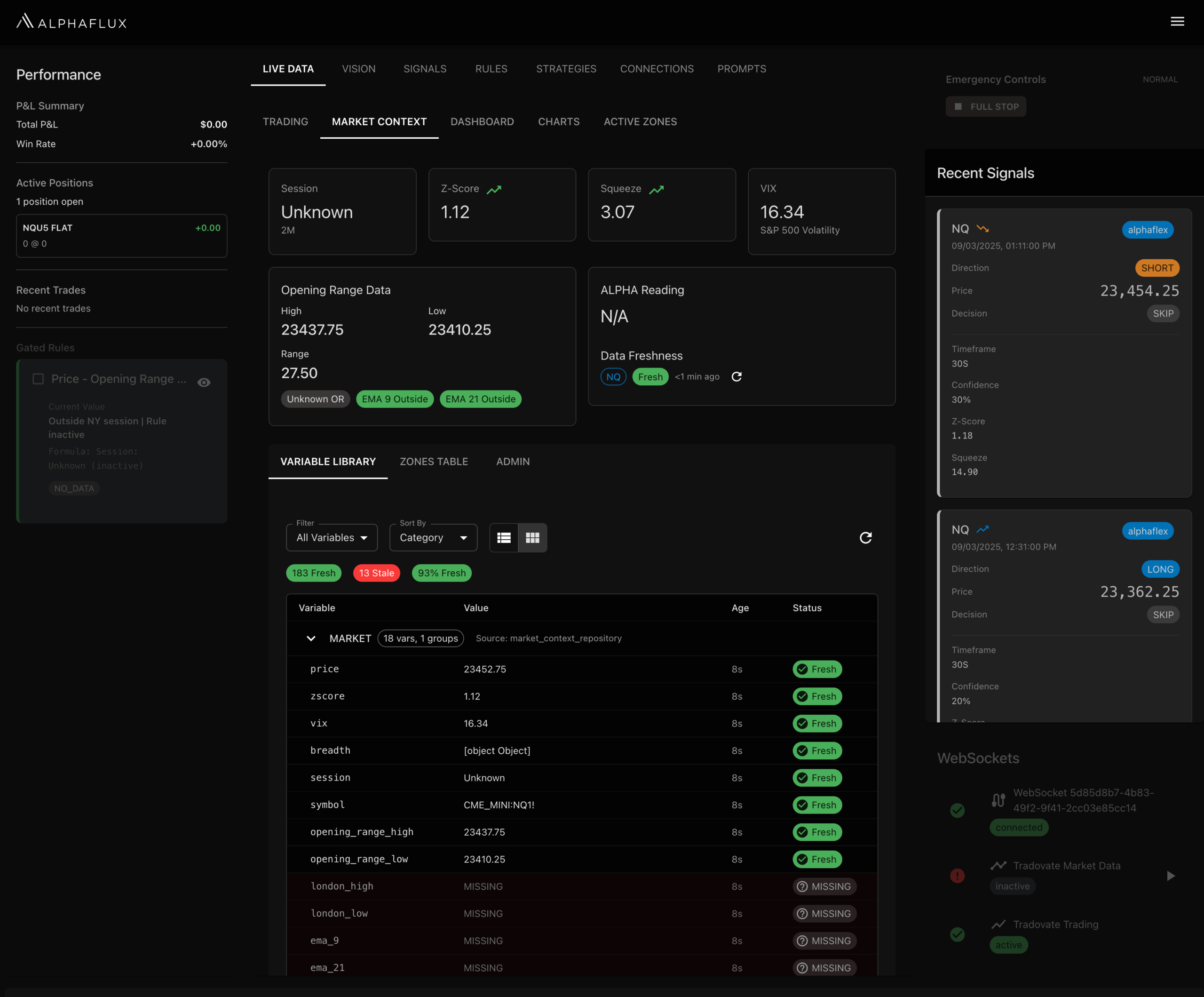

AI systems that process streaming market data with quantitative signal analysis and geometric modeling; each trading decision emerges from consensus among specialized neural architectures, delivering institutional-grade performance.

AlphaFlux utilizes advanced diffusion language models for ultra-low latency decisions, automated pattern discovery, intelligent prompt optimization, and real-time synthesis across multiple specialized neural architectures.

0

Parallel LLM Architectures

0

Consensus Strategies

<0ms

Decision Synthesis

0s

Avg End-to-End Processing Time

including dLLM

AI INTELLIGENCE AT MARKET SPEED

Transparent Decision Making

Every trade comes with a complete audit trail. See exactly what each AI thought, why they agreed or disagreed, and the confidence levels behind every decision.

Autonomous Strategy Generation

Self-evolving strategy architecture that designs and optimizes trading approaches through reinforcement learning. Discover novel alpha patterns, constructs custom logic trees, and continuously refines strategy parameters.

Market Narrative Synthesis Layer

Models process fundamental context, news sentiment, and market commentary. Contextual understanding that adapts to regime changes and market microstructure.

ML Prediction Module

Prediction systems combining classical quantitative models with modern transformer architectures. Multi-horizon forecasting optimized for trading applications

Domain-Specific Reasoning Module

Fine-tuned reasoning engines trained on decades of institutional trading knowledge. Sophisticated logic trees that mirror how elite traders think about risk and opportunity.

Rules Engine

Advanced validation and risk management layer. Intelligent rule orchestration with dynamic weighting and contextual override capabilities.

Diffusion-Powered Model Orchestration

Revolutionary diffusion language model delivers sub-second trading decisions while orchestrating additional specialized AI models in parallel, achieving unprecedented speed without sacrificing analytical depth.